Automated Clearing House Payments

ACH stands for Automated Clearing House. An ACH Transfer is a secure and cost-effective way to move money electronically between local banks. ACH transfers are usually more cost effective and can be more convenient than writing cheques or paying with a credit or debit

Card.

The difference between ACH and RTGS is that in the case of ACH, the settlement of payments is done in batches, while in the case of RTGS, real-time payment is handled individually. Sending money via the ACH is more cost-effective than RTGS, while the RTGS is the fastest way of transferring money.

ACH Transfers to VMBS accounts are delivered daily from other commercial banks and are processed by VMBS at approximately 9:30 am and 2:30 pm each day. Once the funds are posted to the accounts, Members will have immediate access to the funds.

VMBS account holders will not incur a fee for receiving ACH payments, however the initiator of the transactions would be charged by the sending institution.

- Local Transfers can be sent via the ACH network for amounts up to J$1M. Transfers that exceed J$1M should be sent using RTGS.

- It should be noted that if ‘ACH’ is chosen at the sending institution for transactions of J$1M and above, the sending institution will charge the sender penalty of J$5,000.00 per transaction as stipulated by the BOJ policy.

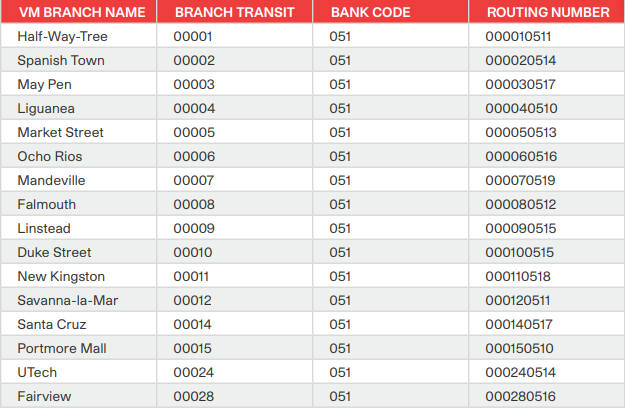

Senders will require the following information to initiate ACH transfers to VMBS:

- Beneficiary Bank: VMB

- BIC: VMBSJMKN

- Beneficiary account: (Member’s account #)

- Beneficiary account name: (Member’s name on the account)

ACH will now make it easier for VMBS to receive salaries and salary deductions on behalf of Members. Employers and payroll organisations will now see VMBS listed among the financial institutions to which they can directly send their staff members’ payroll funds to VMBS Accounts.

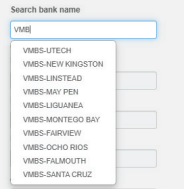

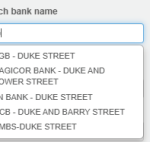

VMBS can now receive Online Transfers from all local financial institutions that use ACH Transfers including Scotiabank. Once online users select Local Transfers via ACH on their banks’ online platform, VMBS is now listed among the list of banks available for the user to select.

VMBS will introduce ACH in two (2) phases. Initially Members will be able to receive ACH transfers to their VMBS Accounts sent from other banks. In a subsequent phase, Members will later be able to initiate ACH transfers to other financial institutions.

ACH stands for Automated Clearing House. An ACH Transfer is a secure and cost-effective way to move money electronically between local banks. ACH transfers are usually more cost effective and can be more convenient than writing cheques or paying with a credit or debit

Card.

The difference between ACH and RTGS is that in the case of ACH, the settlement of payments is done in batches, while in the case of RTGS, real-time payment is handled individually. Sending money via the ACH is more cost-effective than RTGS, while the RTGS is the fastest way of transferring money.

ACH Transfers to VMBS accounts are delivered daily from other commercial banks and are processed by VMBS at approximately 9:30 am and 2:30 pm each day. Once the funds are posted to the accounts, Members will have immediate access to the funds.

VMBS account holders will not incur a fee for receiving ACH payments, however the initiator of the transactions would be charged by the sending institution.

- Local Transfers can be sent via the ACH network for amounts up to J$1M. Transfers that exceed J$1M should be sent using RTGS.

- It should be noted that if ‘ACH’ is chosen at the sending institution for transactions of J$1M and above, the sending institution will charge the sender penalty of J$5,000.00 per transaction as stipulated by the BOJ policy.

Senders will require the following information to initiate ACH transfers to VMBS:

- Beneficiary Bank: VMB

- BIC: VMBSJMKN

- Beneficiary account: (Member’s account #)

- Beneficiary account name: (Member’s name on the account)

ACH will now make it easier for VMBS to receive salaries and salary deductions on behalf of Members. Employers and payroll organisations will now see VMBS listed among the financial institutions to which they can directly send their staff members’ payroll funds to VMBS Accounts.

VMBS can now receive Online Transfers from all local financial institutions that use ACH Transfers including Scotiabank. Once online users select Local Transfers via ACH on their banks’ online platform, VMBS is now listed among the list of banks available for the user to select.